YOUR BLUEPRINT TO LAUNCHING A PROFITABLE

CREDIT Coaching BUSINESS STARTS HERE

Schedule your FREE Consultation Call and learn how to Build, brand, and scale

your own credit Coaching company with the systems and tools we already use to help clients succeed.

WE’VE TURNED CREDIT COACHING INTO A SYSTEM…

Whether You’re Looking To Start Your Own Credit Coaching Business Or Scale What You Already Have,We’ll Give You The Exact Blueprint No Guesswork.

What You’ll Get From This Consultation

Your step-by-step roadmap to start, structure, and grow your credit coaching business the right way.

Learn how to automate sign-ups, handle disputes efficiently, and manage clients with ease.

Get direct guidance from experts who’ve built successful credit coaching companies from the ground up.

Access the same software, scripts, and automation tools our team uses daily to build profitable businesses.

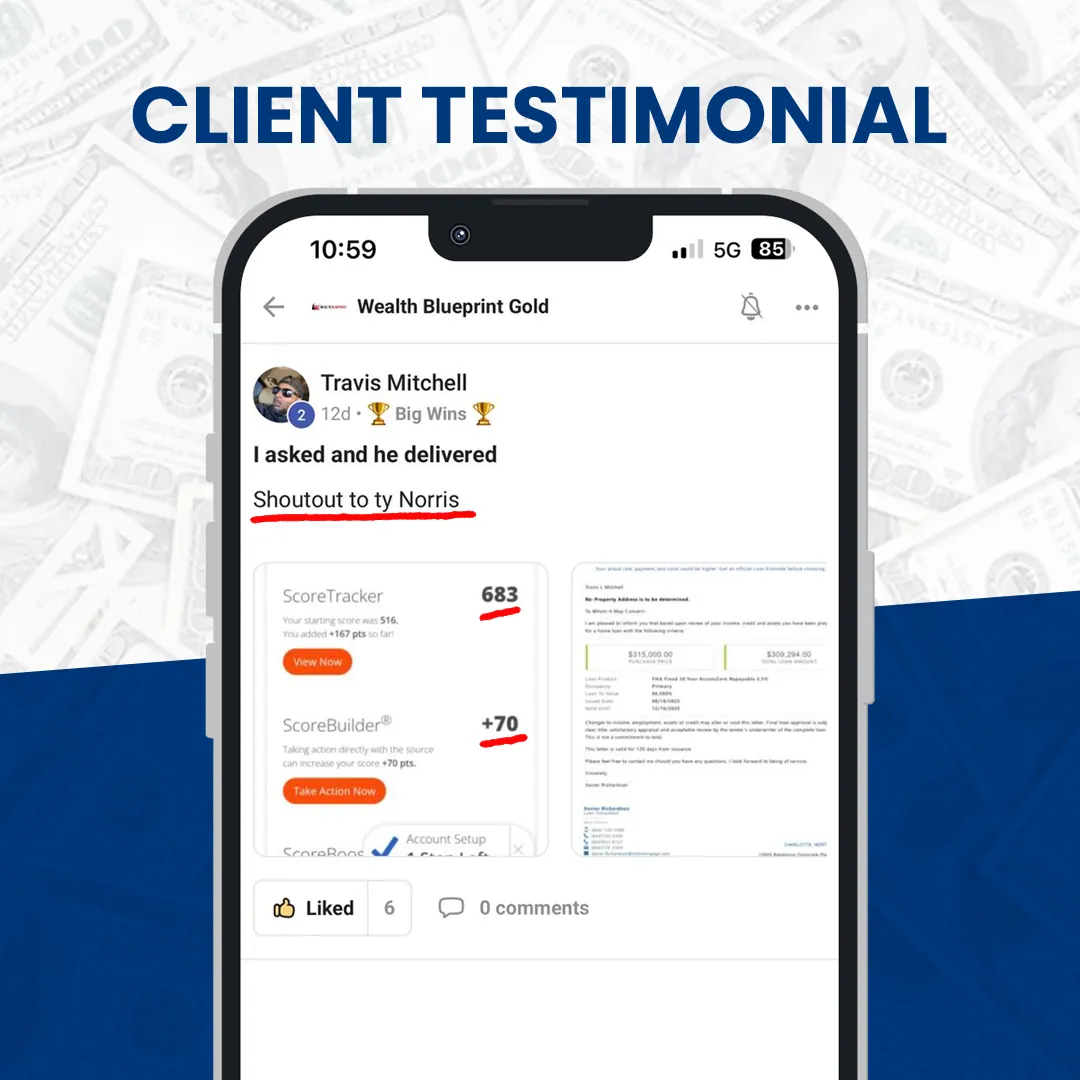

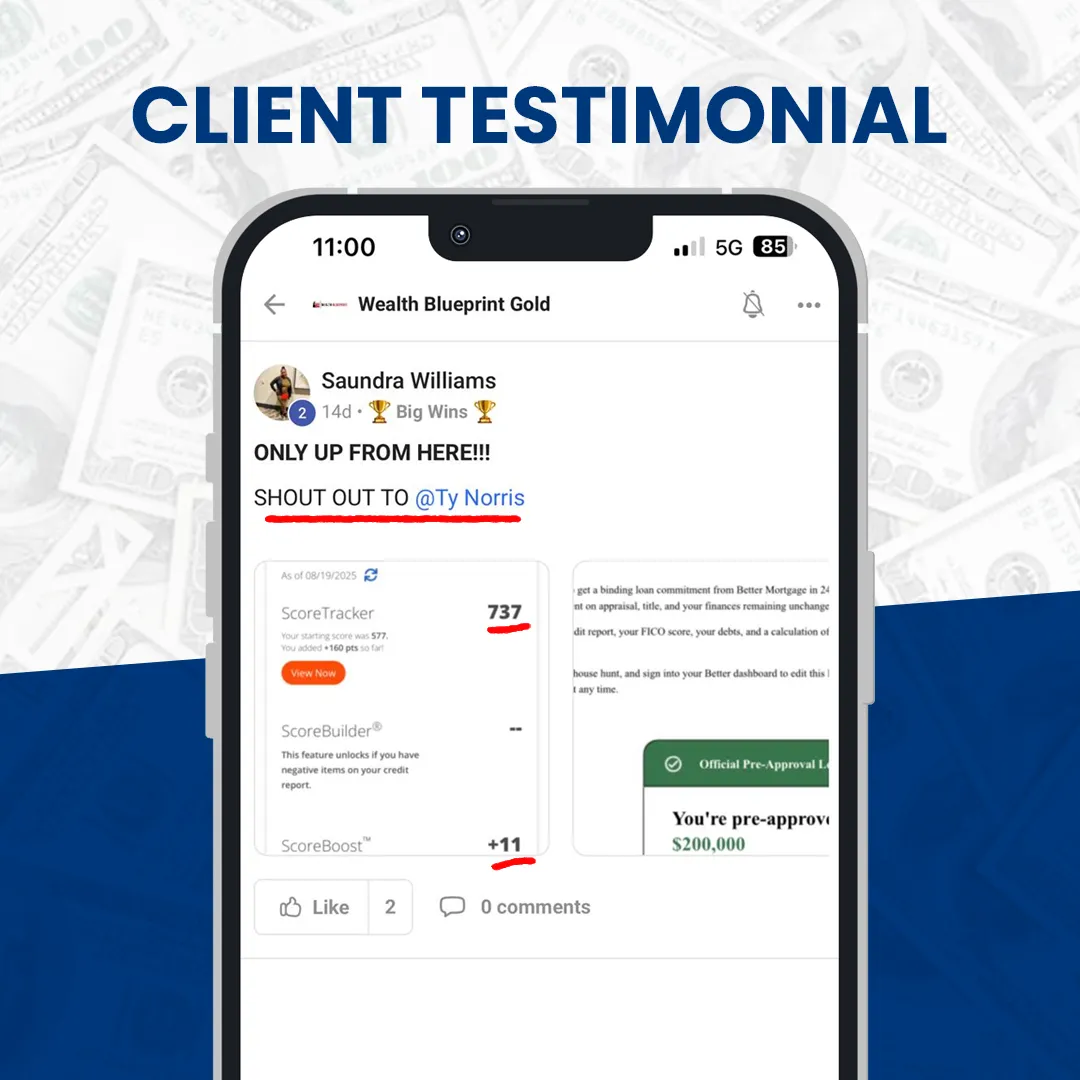

See How I Have Transformed

Their Credit & Future

Ready to Secure Your Future?

Your free strategy session is just a click away

We Just Need a Few Quick Details to Personalize Your Game Plan

We respect your privacy. Your information will only be used to deliver your consultation and follow-up resources.

Will I have a team fixing my clients’ credit on my behalf?

Yes. Our professional dispute team handles all credit repair work for your clients so you can focus on growing your business, not doing the paperwork.

Will I have a system to manage all my leads and clients?

Yes. You’ll get a fully automated CRM that tracks leads, sends follow-ups, and manages your entire business from one dashboard.

Will I have a website already done for me?

Yes. You’ll receive a pre-built, branded website designed to convert visitors into paying clients — ready to go from day one.

Will I get help setting everything up?

Yes. Our onboarding team walks you step-by-step through your setup so you’re never left figuring things out on your own.

Can I reschedule if something comes up?

Absolutely. Life happens. You can reschedule directly through the same link in your confirmation email or text. We do ask that you give us at least 24 hours’ notice so we can open your slot for someone else who’s waiting.

How soon can I start making money?

Many of our members start enrolling clients within their first 7–14 days after setup — your results depend on your effort and consistency.

Can I run this business from home or part-time?

Absolutely. You can run everything 100% online from your laptop or phone, making it perfect as a side hustle or full-time business.

Copyright 2025 | All Rights Reserved.